Editor’s Note: This post was originally published in 2017 and was updated for accuracy and comprehensiveness on March 22, 2024.

Your entire brand experience should work together to deliver the best customer experience possible. This includes your product line-up, promotional campaigns, and loyalty program.

Whether you’ve been running a rewards program for a while or you’re relatively new to rewarding your customers, you need to make sure that the rewards and functionality you’re offering meet your needs and your customers’ needs.

If not, it may be time to migrate your loyalty program.

When your rewards program is not meeting your needs, consider migrating to another loyalty app.

Evaluate the key characteristics of your current program to determine if it is too basic or complex for your brand.

Seamlessly migrate your loyalty program in 4 easy steps.

Consider migrating to Smile.io for a loyalty program designed with simplicity and engineered for scale.

Any loyalty program migration should have 3 phases—protect your data, reorganize your program structure, and promote your program.

So, what do you do if your rewards program fails to meet your needs? Sometimes, the rewards provider you’re working with is no longer the best equipped to support the program you want to run. In these cases, the question quickly becomes—how do you migrate your customers, data, and entire rewards program to another provider?

Migrating a rewards program can present all kinds of challenges. Your customers might be familiar with a specific look and feel, and you might be accustomed to operating and analyzing your program in certain ways.

While it might be a lot easier to simply stick to the status quo, running a rewards program that no longer meets your needs or fits your goals won’t do you any favors in the long run. Investing in your brand and your future by migrating to a new rewards provider is a decision that will set your brand up for success both now and in the future, and, as we’re about to show you, pulling off a seamless migration is a lot easier than you might think.

Table of Contents

- Why migrate your loyalty program?

- How to seamlessly migrate your loyalty program in 4 steps

- Why migrate your loyalty program to Smile.io?

- Making the move to migrate your rewards program

Why migrate your loyalty program?

There are many reasons to migrate your loyalty program to a new software. Launching a loyalty program requires different business needs than several months, a year, or two into your customer loyalty journey.

You wouldn’t continue to invest in a product that customers aren’t purchasing—your loyalty program is no different. If your current loyalty program doesn’t meet your standards in one or more critical aspects, it is time to consider switching loyalty solutions.

Your customers aren’t engaging with your loyalty program

The number one reason to migrate your loyalty program is poor program performance. Before we get ahead of ourselves, let us clarify. We’re not saying to jump ship immediately if you notice a dip in your redemption rate, repeat purchase rate, average order value, or other key indicators. Your customer retention behavior will naturally fluctuate with sale cycles and seasonality. We’re talking about a prolonged period of poor performance.

You can take steps to optimize your loyalty program before switching providers. Adjust reward options, redemption levels, or point-earning values and monitor the results. If you’ve optimized your program and are still experiencing a lack of customer engagement, it’s time to consider migrating your loyalty program.

Evaluate the structure and configuration of your loyalty program. Are you missing top loyalty program features? Is your program visible enough? Explore the features other loyalty program solutions offer to fill the gaps your current provider lacks.

P.S. The results were immediate. Installing Smile.io saved our sales numbers that weekend. Customers were quick to engage, redeem, and order. Install the app now and start boosting your retention revenue.”

- A 5-star Shopify review from a satisfied Smile.io user

You’ve outgrown your current loyalty provider

You may have prioritized simplicity and low costs when introducing your loyalty program. However, as your ecommerce store scales, you should ensure that your loyalty program can keep up. You need a loyalty partner who can handle the growth.

Smaller loyalty apps are great for getting started quickly but lack customization. Often, you’ll hit roadblocks when trying to customize your program’s design—from colors, messaging, banner images, and other key elements. Basic loyalty apps also limit your earning and redeeming options, whereas sophisticated solutions often grant API access to customize your loyalty program completely.

As your brand scales, you may expand into brick-and-mortar locations. With this comes a need for a seamless omnichannel loyalty experience. Ensure your loyalty provider supports POS transactions through integrations with platforms like Shopify POS.

With basic loyalty program software, you receive basic support. If you want to maximize your loyalty program, ensure you trust a team of experts with your customer loyalty. Look into their live support options and written help documents for an indication of the level of support you can expect.

You’re craving a simpler UI and UX

On the other hand, your current loyalty program provider may be too complex for your current needs.

Ask yourself:

- How long and challenging was the launch process?

- Is the program easy to maintain without support?

- Am I constantly seeking customer support?

- How complicated is the back end? Is it user-friendly?

- Am I only using a handful of the features on my plan?

- Am I paying for features that I’m not using?

If you’re looking for a one-of-a-kind hyper-customized loyalty program, you can work with loyalty providers that offer enterprise plans and quotes. But if you’re craving a customizable yet pre-configured program with best practices, you should opt for an easy-to-use solution. The main issue with custom programs is scalability. How easy is adjusting your program as your business grows and needs change?

The other concern with complex loyalty solutions is the price. You’ll likely pay premium prices and face several upselling tactics throughout your relationship with the provider. Loyalty program solutions that offer transparent pricing are more reliable from a cost-consideration standpoint. You can gauge exactly what you get for the price you pay. No hidden fees and no paying for things you don’t need.

After suffering these disappointments, we reluctantly tried Smile.io and quickly regretted not starting sooner. Smile.io is a breath of fresh air!

It took us over two weeks with other apps to attempt a complete setup, but NOT WITH SMILE. We had our loyalty program set up in less than 24 hours.”

- A 5-star Shopify review from a satisfied Smile.io user

You want a best-in-class loyalty program instead of an all-in-one solution

If you currently rely on all-in-one software for loyalty, evaluate the effectiveness of each core function. All-in-one solutions perform multiple functions, whereas best-in-class software solutions perform one function really well and are experts.

With all-in-one solutions, you benefit from less administrative work with one workflow. Still, it often comes at the cost of less-developed solutions, limited integration options with external apps, and trusting generalists with your customer loyalty.

If you’re ready to get the most out of each of your ecommerce marketing apps, it may be time to switch from an all-in-one software that doesn’t excel in any area to several best-of-breed solutions that are experts in their field. When choosing a best-in-class loyalty app, consider one that integrates with other apps for customer service, review generation, email and SMS marketing, and more.

You want control of your program’s analytics and performance

Your customer data is the most valuable output of your loyalty program (aside from financial impacts). Choose a loyalty app that enables you to access, understand, and analyze your data.

Some loyalty programs gatekeep analytics and reports on free plans, which presents a huge problem. How can you improve your customer retention strategy if you can’t analyze your performance?

Opt for a solution with high data transparency. You should be able to access critical metrics like loyalty-influenced sales, redemption rates, program members, and more. This visibility into loyalty reports and analytics allows you to compare your performance against your internal goals, competitors, and industry benchmarks.

You need better security protections

A loyalty program provides valuable first-party customer data. Data that needs to be securely protected.

First-party data encompasses contact information, purchase history, and browsing behavior. Unlike third-party data collected via online tracking cookies, first-party data is obtained directly from the user’s browser with their consent, making it more reliable.

While your loyalty program provides a wealth of customer data that you can use to increase conversions through segmented marketing campaigns, you need to trust your loyalty provider to keep it secure. Ensure you choose loyalty software with sophisticated security protections and privacy policies.

How to seamlessly migrate your loyalty program in 4 steps

If you’ve decided to switch to a new loyalty program provider, you must make the transition seamless for your customers and yourself.

Avoid disrupting the customer experience by working with a team of experts to make the migration process smooth. We break down how to re-platform your loyalty program in 4 easy steps.

1. Export your customer loyalty data from your previous loyalty software

Customer data includes points accounting information—the number of points each shopper has earned, rewards they’ve redeemed, outstanding points, and more. It paints a picture of how customers engage with your program.

Your program data ultimately represents the value your rewards program holds for each customer. If anything were to happen to it, your program members would lose their points balances, VIP status, referral codes, and rewards they’ve worked so hard to earn.

No matter what kind of program you’re running—points, referral, VIP, or a combination of all three—a disruption is a highly negative customer experience that could cost you much more than data. It could cost you the very customers you’ve worked so hard to retain.

If you simply migrate loyalty program software and maintain your ecommerce platform, your historical customer transaction data will remain unaffected. When selecting a new loyalty program software to migrate to, opt for one that is forward-compatible with your ecommerce platform. When customer data syncs seamlessly, it ensures a smoother customer loyalty experience for you and the customer.

2. Import customer point data to your new platform with a CSV file

To migrate your rewards program data to a new rewards solution without significant disruptions to your customers, you’ll need to create a CSV file that lists each of your customer’s emails and how many points they currently have in your program. This data can be retrieved from your current rewards solution and easily formatted for import.

With this spreadsheet, you simply need to import it into your new app to get your program up and running. By the end of the data transfer, your customers will still have their points, and you’ll still have your time, making it a win-win. Customers often won’t notice anything changed with a seamless loyalty program migration.

If you’re looking for a more complex migration that retroactively rewards customers for prior purchases, you must take a few additional steps. While this doesn’t automatically happen with most loyalty program software, you can do this manually with Smile.io.

Simply create a CSV file with 2 columns—emails and points. To determine the points value, export your customers’ “total spent” report from your ecommerce provider. Then, multiply this amount by the number of points you plan to reward for each dollar spent. For example, if you plan to reward 1 point per dollar spent, a customer whose total historical spend is $100 would have accumulated 100 points.

3. Reassess your current loyalty program structure after migrating

Migrating your loyalty program to another provider requires a lot of consideration. Once you’ve decided to make the switch, remind yourself why you made that choice.

Evaluate your program’s performance, structure, and function. Are customers redeeming rewards? Are there additional features you want to explore? Does your program’s branding align with your overall store? Like your brand, your program should evolve and change over time, adapting to suit your shoppers’ needs and behaviors.

While it might be tempting to start imagining massive, structure-altering changes, remember that they can be big or small. Sometimes, the smallest changes can have the biggest impact. Still trying to figure out what we mean? Here’s a list of questions you can ask yourself as you migrate your rewards program:

- Are we rewarding too many or too few points for specific actions?

- Are the rewards motivating and appropriately valued?

- Is this the correct kind of rewards program for our customers?

- Should our referral program stand apart from our points program?

- Would VIP tiers make sense for my products and customer demographic?

- Does the points currency and program name appropriately represent the brand?

It’s also important to remember that the changes you make when you migrate don’t need to be permanent, either! If you make a change and find it’s not working, iterate until you find a solution that works for you and your customers. In the end, your program will be stronger because of it.

4. Promote and “re-launch” your rewards program after migrating

Restructuring your rewards program when you migrate will give you more opportunities to monitor and increase customer engagement, but like any significant change, transparency is vital. You’ll need to make sure your customers are informed of the changes coming to the program.

So, how do you keep your customers informed? Well, the obvious answer is through promotion. When you migrate your rewards program to a new provider, you’re given a unique opportunity to “re-launch” your program to your customers and make a brand new first impression. This is also an excellent opportunity to acquire new customers by encouraging them to join your program.

There are several approaches you can take with your program re-launch campaign.

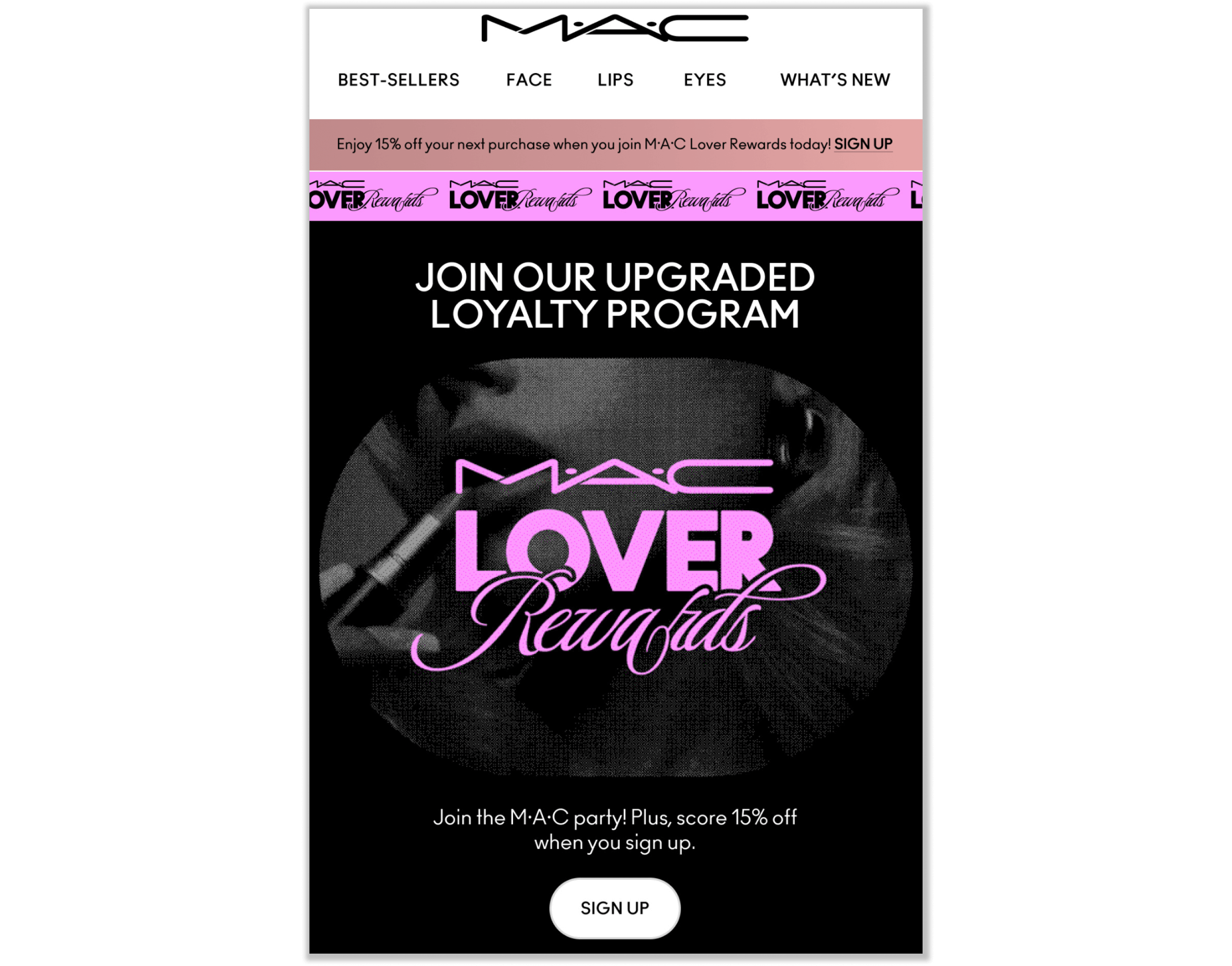

“We’ve revamped our rewards program”

When migrating and restructuring your program, you must re-educate your customers on how your rewards program works. Updating your explainer page and on-site messages will help, but communicating these changes through email, SMS, and social media marketing campaigns is the most effective way to get this information in front of your customers.

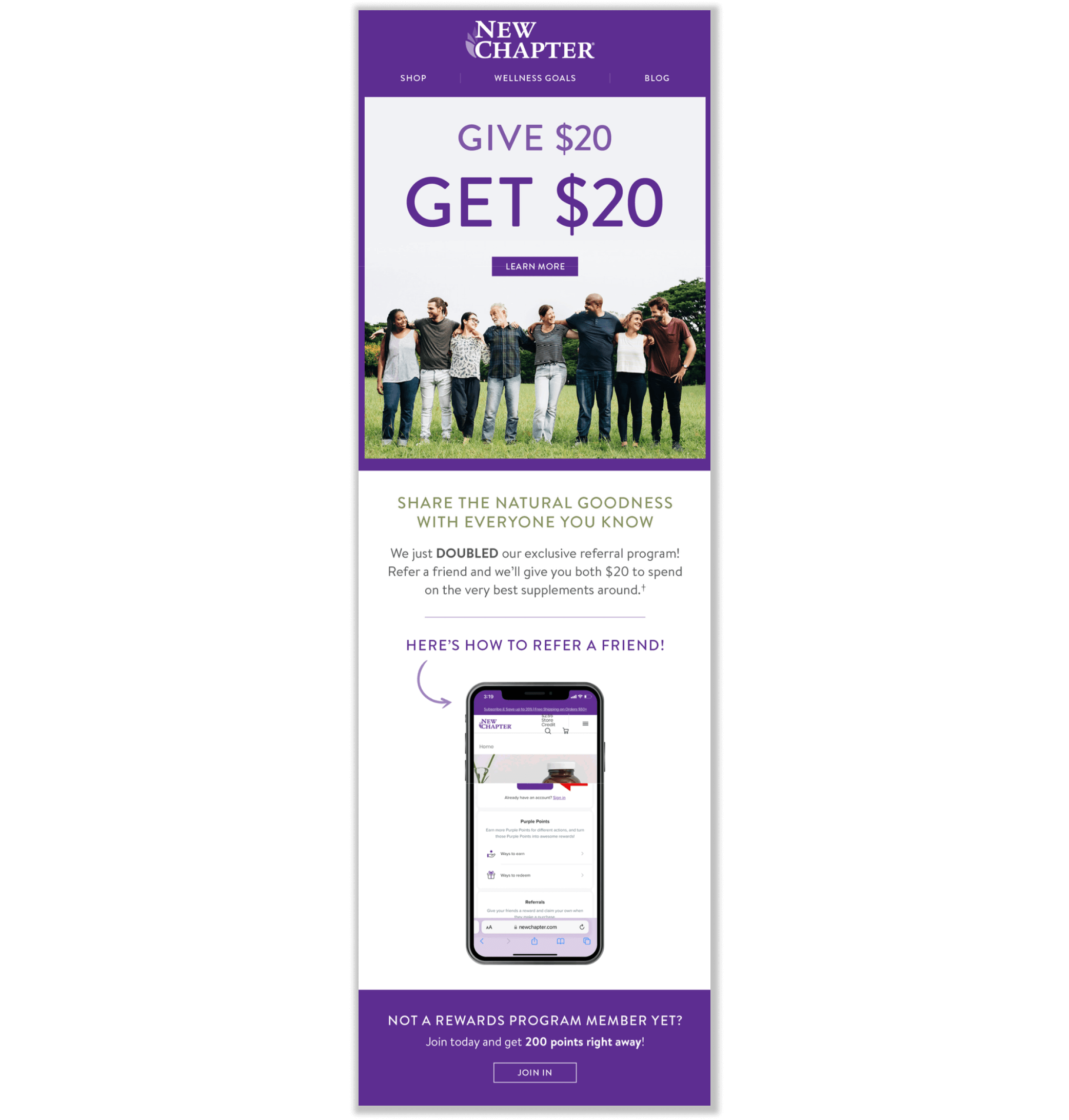

Through an email series, outline the new ways customers can earn and spend points. Provide a link to your explainer page so they can get a visual explanation of how the program works.

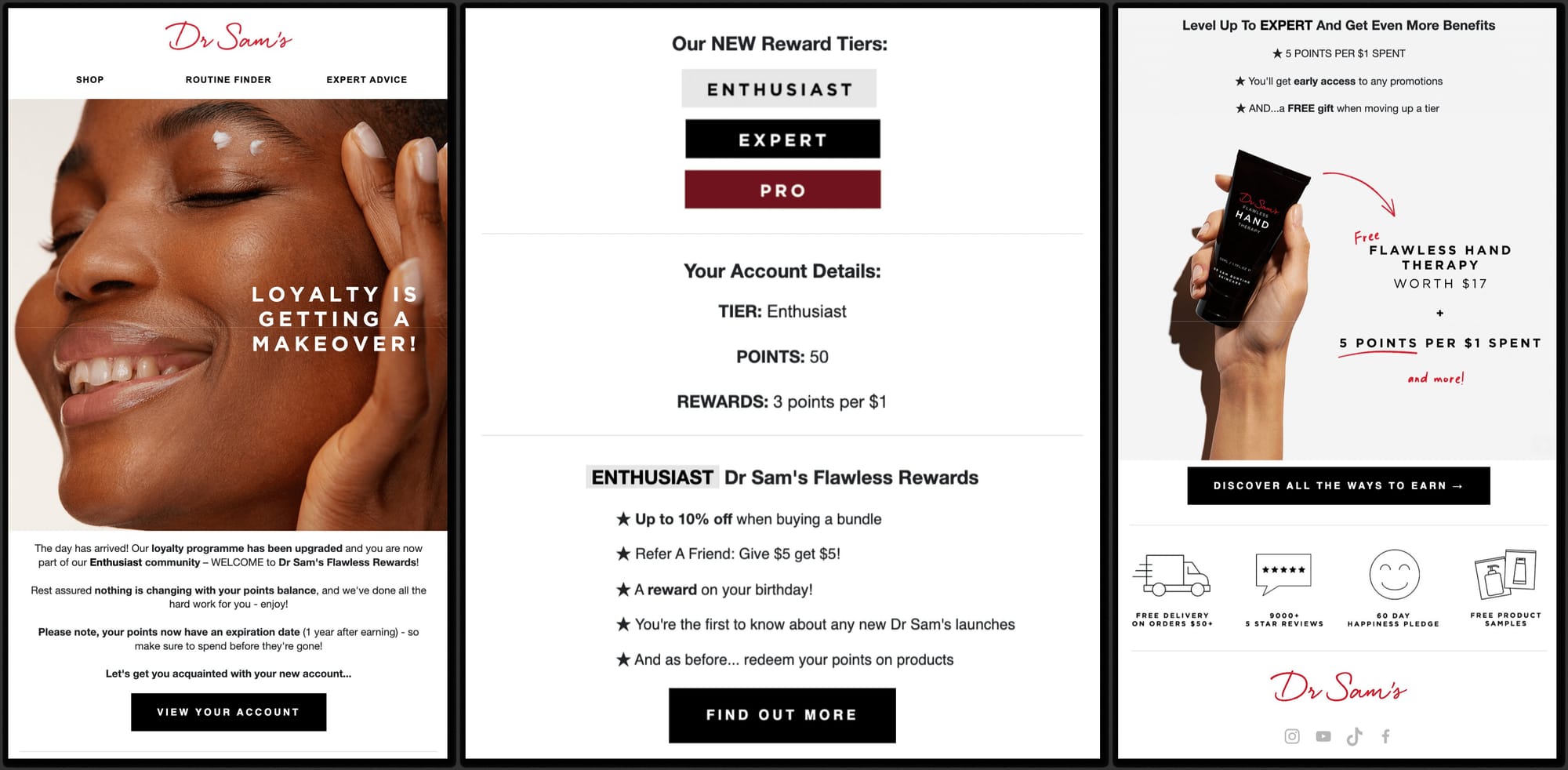

Introducing VIP Tiers

If you’ve added VIP tiers to your program, you must introduce them as it’s a new concept for your customers. Generate excitement by explaining the exclusive benefits they receive by moving up through the tiers. Even if you’re simply refreshing the perks of your VIP tiers, outlining them in an email campaign is a great re-engagement tactic.

With some effort and support from your new loyalty solution team, you can consider customers’ previous point balances when creating a new VIP program. Dr. Sam’s took this approach when migrating to Smile.io from another provider.

campaign with personalized information about the customer’s point balance, VIP status, and eligible rewards. You can also drive conversions by informing customers how close they are to the next tier and what benefits they’ll unlock when they reach it.

Referral-specific promotions

Once you migrate your loyalty program, you may add a referral program. Since you have an established base of loyalty program members, migration is the optimal time to add a referral program to leverage their loyalty and increase conversions. If you introduce this loyalty program feature, you must ensure customers understand how it works, what to do with their unique referral links, and what value they have to gain.

Providers like Smile.io have made it easy for customers to see how well their referral links work with their customer-facing experience. You can turn this into an ongoing part of your rewards program marketing strategy, keeping them updated on how many clicks their link has gotten and how many referred purchases have been completed.

Plan an email campaign that sends each of your program members an update on their unique referral link’s activity. These messages, combined with regular points balance emails and other promotional campaigns, will help integrate your program into your customer’s day-to-day routines and keep them engaged before, during, and after each purchase.

Each campaign is straightforward to set up if your new rewards platform works closely with any email marketing tools. For example, by leveraging the Smile.io and Klaviyo integration, you can send branded email flows for loyalty events like points earned, redeemed rewards, unlocked VIP tiers, and more. This allows you to accurately show customers exactly how many points they have.

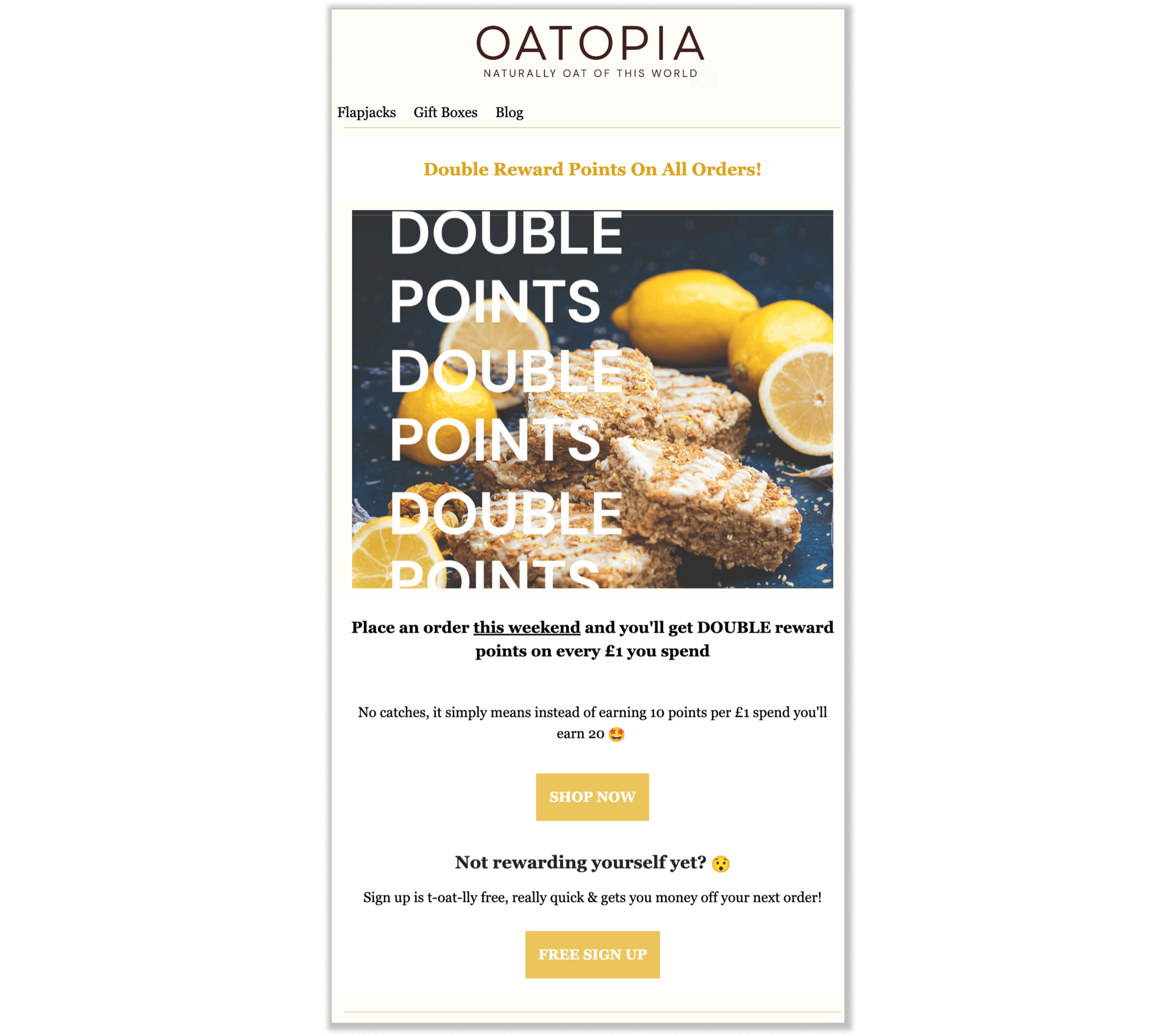

Run a bonus points campaign

To create excitement around your program’s re-launch, you can use your loyalty program as an event-based marketing tool. A great example is a bonus points campaign, allowing customers to earn 2x or more points per dollar spent for a limited period.

Bonus point campaigns effectively boost conversion rates during slower sales periods or re-engage dormant loyalty program members. You can also strategically send this campaign to anyone who’s ever shopped with you to incentivize program sign-ups.

Why migrate your loyalty program to Smile.io?

If you’ve made it this far, you’re seriously considering migrating your loyalty program. We know firsthand that this is a big decision, and we’re here to help you.

As the world’s largest loyalty program provider with over 100,000+ ecommerce merchants running Smile.io, we’re confident that migrating your program to Smile.io is a step in the right direction.

- The most trusted platform by Shopify Plus merchants. Thousands of high-volume Shopify Plus merchants trust Smile.io to run loyalty programs that deliver results. With brands like Polaroid, Monos, Topps, Birchbox, and Hush Puppies powered by Smile.io, we know how to support brands of every size. If you want enterprise loyalty made simple, check out our newest plan, Smile Plus.

- Designed for simplicity. Engineered for scale. Smile.io offers the best loyalty program features, from points programs, VIP tiers, and referrals. Our loyalty programs come configured out of the box with best practices from some of the best ecommerce loyalty programs. With our easy-to-use UI, you’re in complete control of your program—effortlessly customize the design, adjust customer points, analyze reports, and so much more.

- 24/7 support from a team of loyalty experts. With over 100k+ merchants across 148 countries, Smile.io has rewarded over 293M customers on more than 1.41B orders. It’s fair to say we’re experts in loyalty programs. If you’re looking for loyalty advice or support, you can trust our dedicated team of loyalty experts. No need to wait for a dedicated account manager—you get 24/7 access to Smile.io as your partner in loyalty.

- Wide integration network. As a best-in-class loyalty solution, Smile.io is forward-compatible with top ecommerce platforms such as Shopify, BigCommerce, and Wix. You can also trust that your loyalty program will seamlessly integrate with the ecommerce tools you love, such as Klaviyo, Gorgias, Judge.me, and many others.

- Endlessly customizable. No code required. Make your loyalty program yours. Smile.io lets you create a loyalty program that blends seamlessly with your store. Choose your style by adjusting colors, fonts, images, and more with an easy-to-use visual editor. Embed your program across your store with app blocks available on product pages, at checkout, account pages, and more. Or create an SEO-friendly dedicated loyalty landing page to explain your program.

- A 5-star Shopify review from a satisfied Smile.io user

Making the move to migrate your rewards program

Whether you’ve been considering a migration for a while or are just getting excited about it now, we’re happy you’ve made the decision! Finding the platform that’s the right fit for you and your business is just another step towards developing the best possible customer experience for your new and returning customers.

So before you migrate your rewards program, remember:

- Protect your data.

- Reorganize your program structure.

- Promote your program.

With these three steps locked into your migration process, you can begin the exciting process of improving your rewards experience and developing even deeper customer loyalty.