Customers no longer simply appreciate being rewarded for their business—they expect it. Starting an ecommerce store is easier than ever with the rise of ecommerce platforms like Shopify. In a highly saturated market, customers have endless choices of brands to support. The challenge for ecommerce brands is retaining customers and encouraging authentic customer loyalty.

Customer loyalty programs have played a considerable role in fostering repeat purchases. A recent study revealed that 90% of companies offer some sort of loyalty program. If you choose not to provide a program, you risk losing sales to competitors offering customers the additional value they’re seeking.

Shopify reported that 70% of customers consider loyalty programs a leading factor in sticking with a brand, and 80% claim to purchase more frequently after joining a program. Customer loyalty programs are essential to keep up in today’s ecommerce marketplace.

But how do you design a successful loyalty program?

Strategically selecting the right loyalty program features can make or break the success of your retention tactic. The kind of rewards program you use is as important as the rewards you offer. Find out the top loyalty program features of 2024, how to select the best software, and how to implement a program designed for success.

Effective loyalty programs incorporate key features—points systems, VIP tiers, referral programs, seamless integration with ecommerce tools, customization and branding, and analytics reporting.

Determine the best loyalty program software by considering integration compatibility, scalability, support and resources, cost considerations, and user reviews and success stories.

Once you’ve selected software, implement your program by customizing and branding it, integrating third-party apps, configuring your earning and redeeming rules, and promoting your loyalty program.

Table of Contents

- Key features of effective loyalty programs

- Choosing the best loyalty program software

- Implementing your loyalty program

- Choosing the right loyalty program for success

Key features of effective loyalty programs

As a consumer, you’ve likely seen a fair share of loyalty programs. Some encourage you to shop repeatedly, and some quickly fade into the background. The difference lies in the features of the loyalty program. Effective loyalty programs strategically leverage the best features to keep them engaging, encourage higher average order values, and boost repeat purchase rates.

Points systems

Point programs are one of the most common types of loyalty programs because they are easy to understand, quick to engage with, and simple to set up.

Points programs typically reward customers with a predetermined number of points for every dollar they spend. As a rule of thumb, we recommend giving 3-10% back in points for every dollar spent.

You can increase your program engagement by offering points for a variety of other actions like:

- Account creation

- Social shares and follows

- Reviews

- Birthdays

- Anything else valuable to your business.

The effectiveness of any points program relies on how valuable the rewards are. Customers will only be motivated to earn points if the rewards are incentivizing. It’s best practice to offer rewards such as:

- Fixed or percentage discounts

- Free products

- Free shipping

- Gift cards

Flexible points systems are an important tool for ecommerce brands from a brand-building and financial perspective. Traditional loyalty points programs are proven to deliver results. Analysis from Smile Rewards’ network of 100K+ merchants revealed that traditional points programs resulted in a:

- 9% lift in average order value

- 3.3x higher purchase frequency

- 23% less time between purchases

- 56% higher repeat purchase rate

With a points program, you unlock various features that will further drive customer retention and lifetime value. Explore advanced features like points expiration, bonus points campaigns, earning limits, and more to get the most out of your points system.

VIP tiers

Tiered VIP programs reward your top customers with better rewards and exclusive perks. They are a great customer engagement tool and encourage active participation in your store’s program. They typically supplement points programs as an additional form of motivation.

When configuring a VIP program, you can customize it to meet your store’s needs. Adjust specific characteristics like:

- The number of VIP tiers.

- Unique rewards and perks for top tiers.

- Accelerated earning by offering more points per dollar spent in higher tiers.

- Tier entry milestones—choose if customers advance based on total spend or points accumulated.

- Tier status expiry—decide if customers hold their VIP status for their lifetime or a calendar year.

VIP programs offer a variety of benefits—gamification creates excitement, tiers create exclusivity, and you reserve your best rewards for those who earn them.

Aside from transactional rewards, VIP programs allow you to experiment with experiential rewards. For example, you can offer your top-tier customers perks like early access to new products or sales, invites to VIP-only events, or even participation in product focus groups. VIP programs are effective because they create an ongoing two-way relationship between your brand and customers.

Referral programs

While points and VIP programs are effective engagement and retention tools, referral programs are an effective, sustainable acquisition strategy.

You can customize your referral program’s offer with different incentives. Opt for a classic “Give $10, get $10” model, or shake it up by offering existing customers points for their referrals. You can attract new customers with generous incentives like amount or percentage discounts or free shipping on their first order.

Your existing loyal customers are one of your most powerful marketing tools. Leverage a referral program to capitalize on their advocacy. Word-of-mouth marketing is one of the best acquisition strategies because it’s estimated that 92% of customers trust referrals from people they know. This social proof builds a positive perception of your brand, making acquiring a new customer more efficient.

The main benefit of referral programs is eliminating the risk of purchasing from a new brand. Referral programs provide social proof, trust, and reciprocal value. New customers are more willing to buy because they’ve received a trusted recommendation and a discount that softens the financial blow.

Seamless integration with your ecommerce tools

Effective loyalty programs should be easy to implement and maintain. A complicated back-end experience will likely translate into a complex user experience. This is why opting for loyalty solutions that integrate with the ecommerce tools you’re already using is vital.

First and foremost, effective loyalty programs should seamlessly integrate with the ecommerce platform your store is already running on. This allows customer account data to flow effortlessly from one software to the other. This enhances the customer experience by allowing them to log in to one account and access their loyalty program information, purchase history, and other information in one place.

Smile.io integrates with major ecommerce platforms, including Shopify (and Shopify Plus), BigCommerce, and Wix. By working closely with these partners, Smile.io is forward-compatible and can access the best features they offer in real-time.

Aside from your ecommerce platform, effective loyalty program software should integrate with the other ecommerce apps you’re already using. By choosing a best-in-breed loyalty program solution, you benefit from ease of use, expertise and robust data at your fingertips, and the ability and flexibility to use best-in-class SaaS for every aspect of your business.

Customization and branding

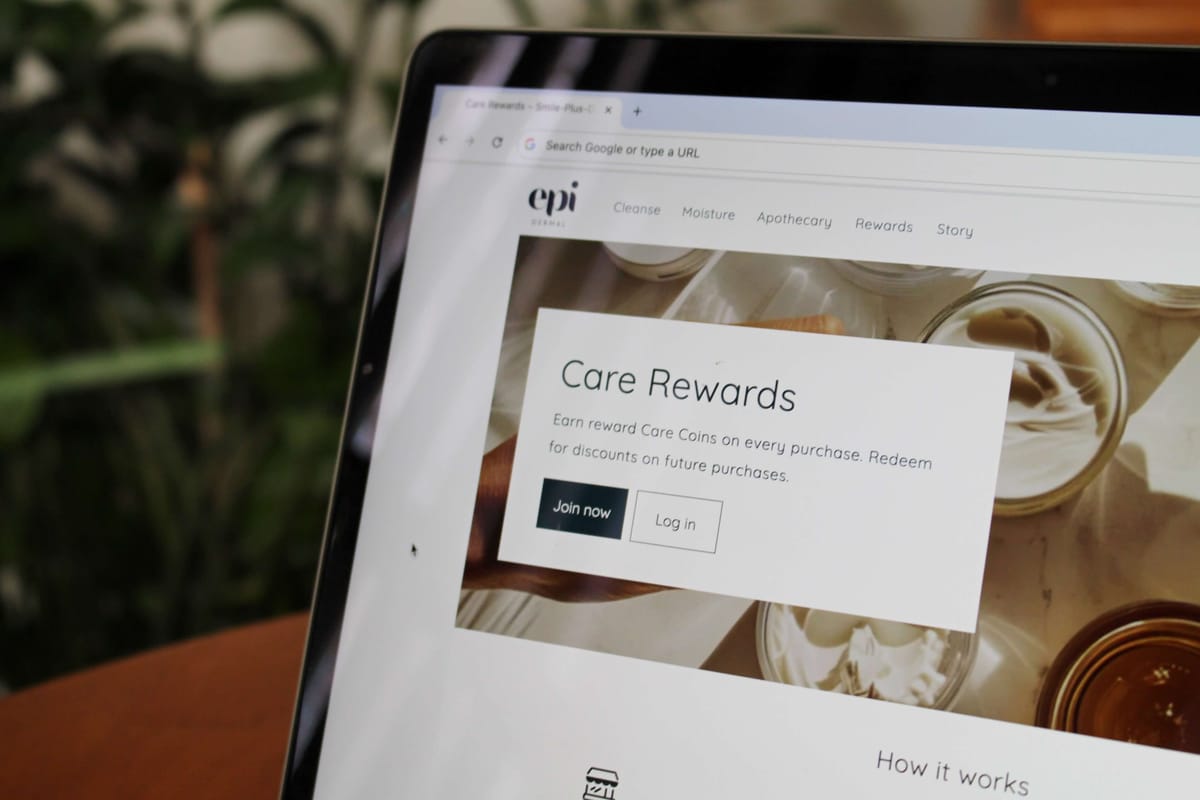

A loyalty program should feel like a natural extension of your overall business. Effective loyalty programs enhance the customer experience. One of the most effective loyalty program features is customization and branding.

Make your loyalty program yours by customizing its appearance. Choose from a floating launcher and panel that acts as a call-to-action on every page, or opt for a dedicated loyalty landing page to give an overview of your program. Or better yet, use the two together.

With Smile.io, you can pick the colors, shapes, and sizes of icons in your loyalty program launcher with an easy-to-use visual editor. You can then customize where loyalty information is displayed on your site with embedded content options like points on the product page, account page, checkout page, and more.

Analytics and reporting

Any good loyalty program comes with good analytics and reporting. You need to be able to monitor the success of your program to determine the effectiveness of any other feature. Opt for a loyalty program with sophisticated analytics to get the most out of loyalty.

Effective loyalty programs will provide insight into key retention metrics like repeat purchase rate, average order value, purchase frequency, and more. These analytics significantly impact your bottom line, so setting your brand up for success and monitoring these over time is essential.

With Smile.io’s newest plan, Smile Plus, ecommerce merchants can access 25+ specialized reports that will help elevate their loyalty strategy. With readily available information on program performance, customer segments, and financial loyalty data, brands can leverage their loyalty program to drive conversions and profits.

Detailed analytics help ecommerce brands track and optimize their program’s performance by providing a baseline against which to measure progress over time.

Choosing the best loyalty program software

Once you know what features to look for in a loyalty program, it becomes a matter of choosing the right software for your brand. Since several loyalty program solutions offer a number of these top loyalty program features, we’ve put together a list of factors to consider.

Integration compatibility

Integration compatibility is the first thing to consider when choosing a loyalty program software. Does the loyalty program easily integrate with your ecommerce platform, email and SMS marketing system, customer service or live chat software, and all the other tools you’re using?

If the answer is no, you’ll have to determine your priorities. Are you willing to swap your other ecommerce apps to use this loyalty program? Or does the loyalty program software you’re using come as part of an all-in-one ecommerce solution? In this case, you may have to drop some of your existing software in your ecommerce software to use their solutions. Determine what makes the most sense for your brand. Which ecommerce solutions are a “must” that you’re not willing to forgo?

Sophisticated loyalty solutions may offer API access for specific plans that also allow you to build third-party app integrations.

No matter which loyalty program software you choose, ensure it integrates with the rest of your ecommerce tools. This allows the software to speak to each other and relay customer data in real time to optimize for conversions.

Scalability

No matter how big your ecommerce brand is now, the goal is to scale. You need to select a loyalty program that can grow with your business.

A good indicator is the pricing page and the software’s different plans. By looking for characteristics like order limits or feature options, you’ll get insight into the size and scope of brands that the loyalty solution can support.

An app with a highest plan of $50/month for stores with 500 orders/ month will offer a very different product than one with a plan costing $999/month for brands with up to 7,500 orders/month.

If you’re just starting with loyalty, this may not seem a big concern. But as you scale your business, you want a loyalty program that can keep up with customer demand. You’ll be set from the start if you choose a solution that caters to every business size.

Support and resources

Whether you’ve been running a loyalty program for years or are just getting started, one crucial factor is the support and resources you’ll receive from the team behind the loyalty SaaS. Having access to a skilled team of loyalty experts primes you for success.

Look at the customer support details when comparing loyalty alternatives. How often can you reach a support team? What level of support do they offer? Do they provide written help support documents? Do they appear to be loyalty experts?

When it comes to your customer loyalty, you don’t want to take a gamble. Trust that your loyalty program is in good hands by choosing a provider with high-level expert support.

Cost consideration

The price has to be right. As with any marketing or business software, you’ll have cost considerations that impact your decision.

Look for free trials, various pricing plans, additional feature costs, custom pricing quotes, and other price considerations. The most important factor is whether or not you’ll see a positive return on investment (ROI) from the cost of the loyalty software.

With loyalty programs, you need to consider the subscription charge and the financial implications of the rewards you offer. Choosing a loyalty solution that boosts repeat customer rate, average order value, and purchase frequency is vital to ensure that the benefits outweigh the costs.

User reviews and success stories

Trust a loyalty program that other ecommerce brands trust. Just as reviews are valuable for your store to encourage purchases, user testimonials and success stories are a great leading indicator of the efficacy of a loyalty program software.

Look at ecommerce app store reviews, read testimonials on the website, and dive into case studies to see how other stores are finding success. There’s no need to reinvent the wheel when it comes to loyalty programs—learn from the experience of others.

Implementing your loyalty program

Once you’ve determined what loyalty program features you need and select software that meets your needs, it’s time to implement your loyalty program. You should take a series of critical steps when implementing a loyalty program.

1. Brand your loyalty program

Once you’ve determined it’s time to launch your loyalty program, it’s time to customize the look and feel of it. This involves naming your program, points currency, and VIP tiers. These will ensure that your program is easy for customers to remember.

You can also customize colors, fonts, messages, and banner images to ensure your program is a natural extension of your overall brand.

2. Integrate third-party apps

Effective loyalty programs enhance the customer experience by seamlessly integrating with other core business functions. Popular app integrations are email marketing, customer service, and review generation.

Take some time to integrate all your current software with your loyalty program to make the most of both software from day 1.

3. Configure your earning and redeeming rules

No matter what loyalty program features you opt for, you’ll need to establish how customers earn points that they can redeem for rewards. With a points program, you should reward points for every customer purchase. To increase program engagement, consider rewarding social shares and follows, birthdays, product reviews, account creation, and more. You’ll then need to determine the point value of each of these actions.

You’ll also need to decide what rewards and perks you will offer—discounts, free shipping, free products, early access to sales, exclusive VIP events, etc… Once you have a list of rewards, you’ll need to value them. How many points will customers need for each reward?

4. Promote your program

Once your program is live, it’s time to promote it so customers can start engaging. Use effective launch campaign strategies like email marketing, SMS marketing, or social media posts.

For best results, add a dedicated loyalty landing page to your website to direct traffic to. This clearly explains your program to customers and simplifies their journey.

Choosing the right loyalty program for success

Not all loyalty programs are created equal. From the punch card model to multi-tiered VIP programs, loyalty and rewards programs come in all shapes and sizes. The key is selecting the best loyalty program features for your business needs.

Smile.io offers all of these features and more, with loyalty programs designed for simplicity and engineered for scale. If you’re ready to get started with loyalty, join over 100,000+ ecommerce merchants who trust Smile.io with their customer loyalty programs.