In ecommerce, acquiring customers is only one piece of a big pie. It’s equally important that you understand and track how receptive your existing customers are to your brand, and find new ways to grow the profitability of your business.

In terms of growing profitability, you’ve got two main options–you can focus on getting people to buy more during each visit (average order value) or you can get them to shop with you more often (purchase frequency).

What is Purchase Frequency (PF) and why is it important?

Purchase frequency is a measure of how often your customers are shopping with you. It helps you determine if your sales are coming from one-time purchases or repeat customers. Since repeat customers are more profitable, you’ll want to aim for a high purchase frequency.

Purchase frequency is the average of how many orders customers make in a year for a given store.

Usually, a high purchase frequency means repeat customers and therefore higher brand loyalty. However, this depends on several factors such as the products you sell, your industry, and economic conditions. No matter what, retaining loyal customers is the ultimate goal so let’s find out how to calculate and increase your own purchase frequency.

"In recession times, you can't bring that many new customers in the funnel, so care and show some love to existing customers. Bring them back and increase their purchase frequency"@mrleszczynski @girls_marketing @MaDamarzo @sevilozer #GlobalMarketingDay pic.twitter.com/qDECVPnF0g

— Semrush (@semrush) February 17, 2023

How to calculate purchase frequency)

When you’re searching for ways to grow profits, a good place to look for inspiration is your retention metrics. Before trying anything new, you need to know how you’re currently doing. You know the classic saying–if it isn’t broken, don’t fix it.

But, that doesn’t mean you can’t always improve. Calculating your current retention metrics will give you a benchmark to compare the results of your new retention efforts to. With metrics like Purchase Frequency (PF), this analysis can lead to valuable insights.

Calculating Repeat Purchase Rate (RPR)

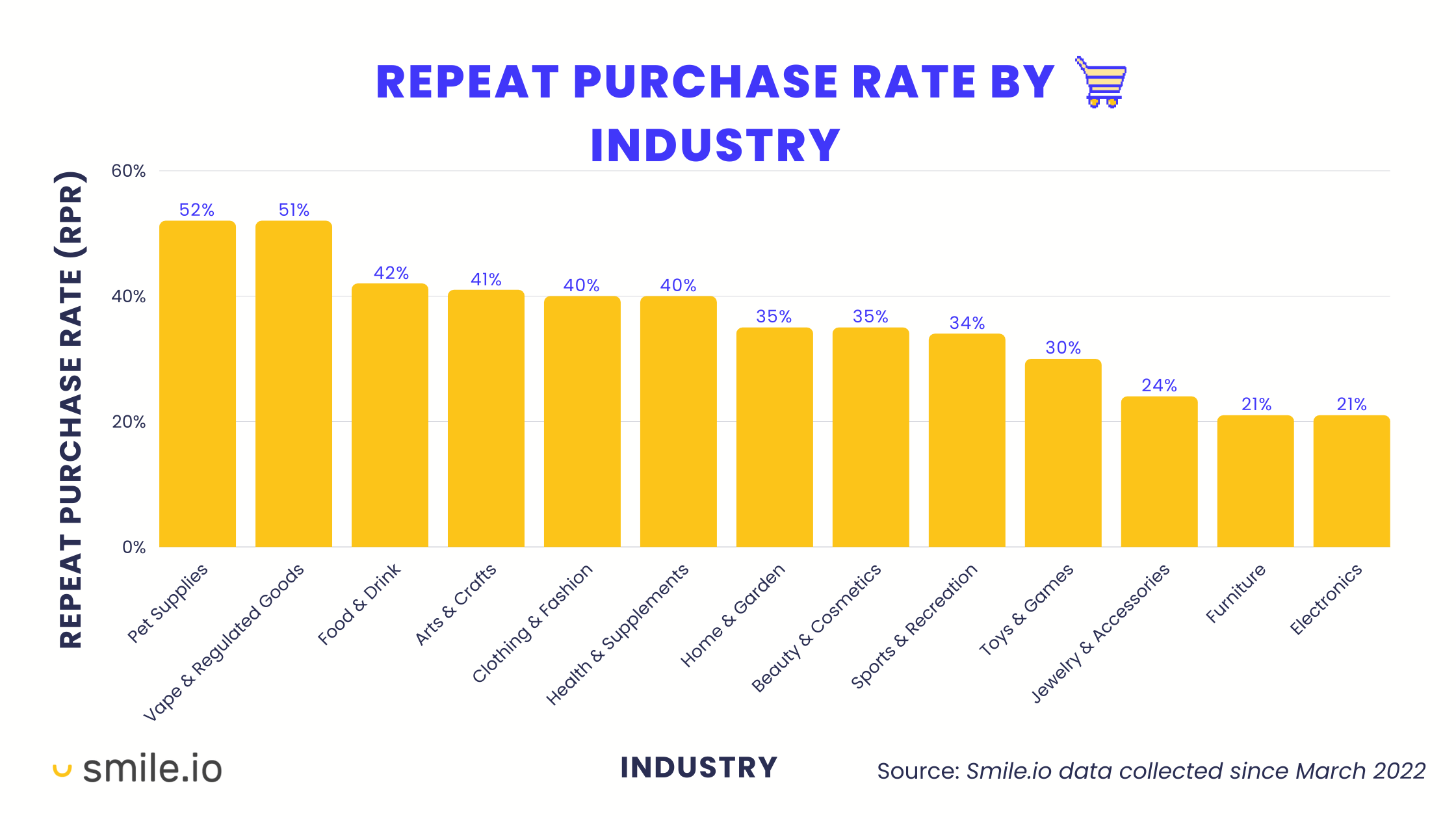

The repeat purchase rate is a calculation showing the percentage of your current customer base that has purchased at least a second time within a year. This metric is influenced by your customer retention efforts and is a good indicator of the value you are providing your customers.

A good repeat purchase rate is dependent on the industry–if you sell high-price, long-lasting items, don’t expect your RPR to be as high as a brand that sells low-cost consumables. Having a high RPR indicates that you are providing a lot of value to your customers compared to the price of your products.

Even if you sell expensive products, your goal is to still have a reasonable RPR to indicate that your customers find value in your brand. You may want to adjust the time period you calculate your RPR for. For example, if you sell furniture like couches or desks, it’s unlikely customers will make several purchases in one year. You can calculate your RPR for 18, 24, or even 30 months to make this insight more valuable for your brand.

With your RPR calculated, you’re one step closer to your Purchase Frequency.

Calculating Purchase Frequency (PF)

Purchase Frequency is a metric that shows the average number of times a customer makes a purchase within a set time frame. This provides you with insight into how to structure your marketing to best suit the buying behavior of your audience. While knowing the number of purchases is useful, it is also important to actually do something with that number.

PF can be utilized in different ways by changing the time frame. Generally, you should look at data during a one-year period to have a broad view of consumer buying habits (like holiday and sale shopping). You can extend or shorten this depending on your business needs. No matter what time frame you choose, it is important that you include “unique” purchasers in order to avoid including duplicate purchases in your calculation.

- Smile.io data

So now you know what percentage of your customers come back, and how often they make purchases within a given time period. The icing on the cake is taking those metrics and using them as a benchmark for influencing how often those customers come back to make another purchase.

Calculating Time Between Purchases (TBP)

Time Between Purchases is exactly that metric that shows you how often a typical customer goes before making a repeat purchase. This is a good stat to know because it allows you to tailor email marketing campaigns to their behaviors. If you know the average customer takes 7 weeks between their purchases, you can start sending promotions during weeks 5 or 6 to get them back a little sooner than they normally would.

Time between purchases will vary significantly between industries. Like repeat purchase rate and purchase frequency, if you are selling furniture you will probably see longer times between purchases than in the average coffee shop. The best practice is to try and find another merchant in your industry that you can compare to. If you can’t find a comparable merchant, just use your current frequency and always try to improve from there.

The time between purchases and repeat purchase rate are critical metrics on your road to increasing purchase frequency, which means that they shouldn’t be taken lightly. Do not restrict yourselves to calculating these metrics on an annual time frame. Feel free to play around with them and test them with different customer segments. But most importantly, do not forget to track, track, track!

3 Tips to increase purchase frequency

Now that we know how to calculate purchase frequency and what it means for your store, we can begin to look at ways to increase it. The goal here is to motivate your existing customer base to buy more often.

1. Create retention email campaigns

Email marketing is one of the most effective marketing tools that an online store has at its disposal. Email marketing works wonders for increasing your repeat purchase rate. A classic example of email marketing in action is sending a “we miss you” winback email to dormant customers. This is an email you send to a customer who hasn’t made a purchase in a while and who might be moving outside of your normal purchase frequency average.

A winback email works best if you have information about their last purchase. This way you can make a new recommendation based on what they like. This strategy is also more effective if you provide an incentive with the email. This ties into personalization and delighting customers, and overall provides a one-of-a-kind customer experience.

You can also use email marketing to increase purchase frequency. The trick is to occasionally email offers that are relevant to that particular customer. If there’s a new product in the collection they purchased from previously, show them the new selection that just came in.

The more personalized an email is, the better conversion rates

Urgency is another amazing tactic you can and should utilize in your email marketing. Creating a sense of urgency nudges your customers to buy your product more frequently. One way you can create a sense of urgency is by using time-based marketing messages like: “While quantities last” “Limited edition item”, or “One day sale!”. You want to encourage that customer to buy now! But, be leery of doing this too often, as it can cause a sort of “discount fatigue” where your products appear to have less value.

Email marketing is a fantastic way of getting customers to know you and vice versa, so take advantage of this channel. Track open and conversion rates to see if what you are putting out is actually effective, and iterate on the next one to see how you can improve.

2. Start a rewards program

A loyalty program can actually help with both average order value and purchase frequency. Enrollment in a loyalty program encourages a customer to shop with you again (increasing repeat purchase rate) instead of choosing a competitor. Once a shopper is enrolled you can use points to motivate them to shop more frequently (increasing purchase frequency).

Increase your purchase frequency by encouraging loyal customers to spend points to redeem rewards.

You can also team up your email marketing and loyalty program to increase purchase frequency. You can incorporate points in your emails as an incentive to get customers to return. Show them the points balance they have, or even what they can spend those points on. You could also give extra points on certain days to encourage customers to buy now.

A loyalty program encourages shoppers to return to your store by establishing a switching barrier. When a shopper has points, it is more difficult to choose a competitor than forgo those hard-earned points. Once a shopper is hooked on your brand through points, you can start using points to motivate other profitable behavior like referrals.

3. Introduce elements of gamification

Do you remember those moments when you’re having fun collecting points, getting ahead of your friends on a leaderboard, and feeling successful in accomplishing something? That’s gamification. Gamification is the addition of game mechanics in situations that are not particularly tied to gaming.

PQ: Ecommerce + Game Mechanics = Loyal Customers

Mobile apps have made gamification tactics famous with the use of badges, leaderboards, and ranks. These tactics can be replicated to keep customers engaged and increase your business’ purchase frequency. Gamification motivates customers to immerse themselves in your brand by earning points and receiving rewards.

Badges and ranks are two gamification elements that can be used together to create a culture where each shopper is striving to be the best. While your customers are journeying through your product, you can delight them with points and perks which increase their customer experience.

The Purchase Frequency TL;DR

Now you have the right tools and tips to increase your purchase frequency! Your next steps are executing these tips:

- Calculate your RPR, PF, and TBP to create a benchmark.

- Send retention-focused “winback” emails.

- Start a rewards program to hook customers into your brand's ecosystem.

- Use gamification to motivate continuous engagement.

- Track how you’re doing compared to your own and industry benchmarks.

Editor’s Note: This post was originally published in July 2019 and was updated for accuracy and comprehensiveness on March 27, 2023.