Churn is something that all businesses, big and small, have to deal with. While you’re busy working hard to acquire new customers, you’re bound to lose some existing customers along the way. Your churn rate is the metric that defines just how many customers you're losing over a period of time and can be calculated using a churn rate formula.

Churn rate is a business metric that calculates how many customers you've lost over a given period of time as a percentage of your total customers.

While it can be unpleasant to think about losing customers, understanding churn and the conditions that cause it will have a huge impact on how customers relate to your brand. After all, the first step to minimizing your customer churn rate is understanding it.

How to Calculate Customer Churn Rate

Customer churn rate is calculated by dividing the amount of customers you’ve lost over a given period of time by the total number of customers from that period. This calculation allows you to see your churned (or lost) customers as a percentage of your overall customer base.

Churn Rate Formula: Churn Rate = Customers lost (per period) divided by total customers (per period)

How Do I Know How Many Customers Have Been Lost?

Step 1: Segment by Purchase Frequency

The first step to determine if a customer has actually been lost (and should be factored into your churn rate formula) is to segment your customers by purchase frequency. Then, use the purchase frequency data to identify a certain length of inactivity after which a customer is likely to never return.

For example, if your data suggests that after one year of inactivity 90% of customers never return to make another purchase, then you can use one year as your benchmark for a customer to be considered lost. Similarly, if a customer makes one (or more) purchase(s) within the year, they are considered an active customer.

Step 2: Subtract Active Customers From Total Customers

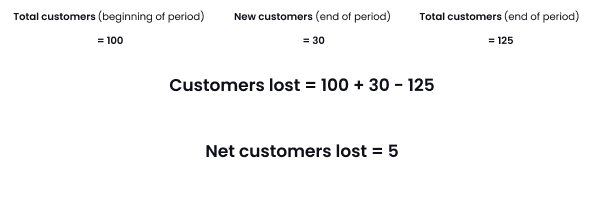

Once you've determined a length of time to consider a customer active or lost, you can do some simple math to figure out your net number of lost customers. To do this, take your amount of active customers from the beginning of the period and add the number of new customers who have shopped with you for the first time during that period. Then, subtract the amount of active customers at the end of the period. This will give you your net number of churned customers.

For example, if you had 100 active customers at the beginning of the period, gained 30 new ones, and ended with 125 active customers, you’ve effectively lost 5 customers.

Even though you grew your customer base from 100 to 125, 5 of your customers still churned. Some analysts get distracted by growth numbers and forget to consider the churn happening under the surface. In this example, you would have a customer churn rate of 5%.

So, there you have it. Customer churn rate the quick and easy way. Now that you’ve got your churn rate basics down we can focus on strategies to decrease it.

2 Strategies to Decrease Churn Rate

Now that you know how to calculate your customer churn rate using the customer churn rate formula, we can look at ways to decrease churn and keep more of your customers coming back to your store.

1. Delight Your Customers

The most fundamental way to decrease your churn rate is to keep your customers happy. Easy, right? While you definitely want to avoid letting your customers down, you also have to look for opportunities to go above and beyond your customers’ expectations and delight them.

Impressing your customers is an important factor in increasing your brand’s overall level of customer satisfaction. Many marketers view customer satisfaction as a light switch—something that is either on or off. But in reality, customer satisfaction is a lot more like a spectrum.

As you achieve higher levels of customer delight, your customers start to perform positive, value-affirming actions like repeat purchasing or becoming brand ambassadors. On the other hand, the lower your levels of customer satisfaction, the more at risk your customers are of churning.

Each time a customer interacts with your brand you have an opportunity to move them further along the customer satisfaction spectrum.Whether it’s information they find in the pre-purchase phase, your product itself, the rewards in your loyalty program, or even the support they receive when something goes wrong, look for opportunities to delight them every step of the way.

2. Create Positive Switching Costs

Any cost that a customer incurs by trading one product or service for another is referred to as a switching cost. Higher switching costs naturally decrease churn by reducing the likelihood that a customer will switch to a substitute product instead of returning to your brand.

Switching costs reduce the probability that a customer will leave you for a competing brand.

Traditionally, marketers have shied away from creating switching costs for fear of “imprisoning” their customers and creating a forced commitment rather than genuine affection for their brand. To see the dangers of a negative switching cost at work you don’t have to look much further than the telecommunications industry where switching costs take the form of harsh financial penalties.

But switching costs don’t have to feel like a prison! In fact, positive switching costs can actually be useful elements of your brand that help to build relationships with your customers.

A great way to create positive switching costs is by implementing a loyalty program. By rewarding your customers for purchases or other acts of brand loyalty, you’re providing them with value that acts as a switching cost. This means that if customers choose to leave you for another brand, they’ll be giving up their points, or their progress towards some really awesome rewards. The effect of rewards as a switching cost can be a subtle but powerful tool in effectively reducing your churn.

How to Learn From Your Churn

They say that all good things must come to an end, and this idea sometimes extends to customer relationships. Churn is a natural part of doing business and there isn’t a brand on earth that can boast a 0% churn rate. However, by understanding your churn rate, delighting your customers, and creating positive switching costs, you can ultimately reduce the impact that customer churn has on your business.

Editor’s Note: This post was originally published on February 16, 2018 and was updated for accuracy and comprehensiveness on October 8, 2021.