Editor’s Note: This post was originally published in May 2015 and was updated for accuracy and comprehensiveness on August 2, 2017.

Customer lifetime value is one of the most important metrics an ecommerce merchant can keep tabs on. If you are not familiar with the term “customer lifetime value”, you may know it by one of its other names: CLV, lifetime value, LTV, or total customer value.

Regardless of how you refer to customer lifetime value, it’s very important to guaranteeing your ecommerce livelihood! The calculation allows you to determine what each acquired customer is worth to your store in the long run. This one of the most useful ecommerce metrics because it allows you to determine a few key things, like how much you can afford to spend on acquisition and what you should spend to retain each customer and thus drive the right business results outlined in your growth strategy.

Traditional Customer Lifetime Value Calculations Are Confusing

In theory, customer lifetime value should allow every ecommerce merchant to accurately assess if their marketing budgets are in check. However, this isn’t the case for most merchants.

The number one reason customer lifetime value is ignored is because it is confusing. A quick Google image search for “customer lifetime value calculations” will show you how complicated these formulas can be.

If you have a university math or finance degree, go ahead and take a stab at using those calculations. These complex calculations will give you an accurate value but they are overkill for most online stores. So if those formulas make your head spin (join the club), keep reading for an easier solution.

The Easy Way to Calculate Your Customer Lifetime Value

Customer lifetime value calculations become much easier when you break them down into digestible chunks, and explain each step along the way. We will start with how to get the variables you need and then move to the individual components of the calculation.

All calculations can be done using weeks or months just be sure to adjust the equations to reflect the time period you are working with.

Variables You Need

We will start with the calculations you need before you look at CLV.

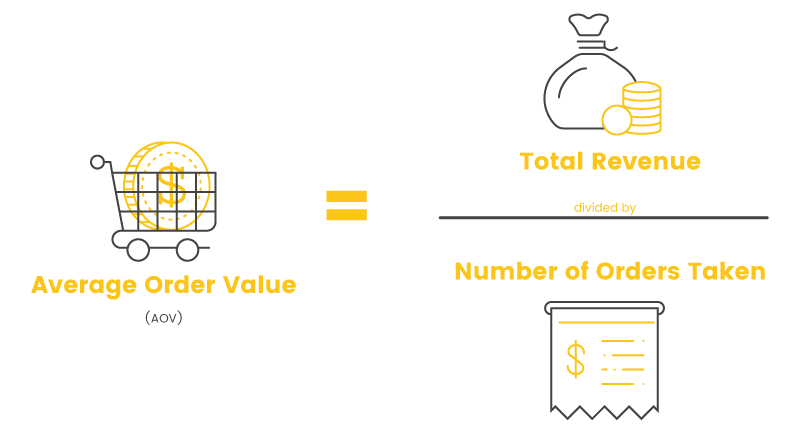

1. Average Order Value (AOV)

Average order value (AOV) is pretty self explanatory, it gives you the average of how much is spent on your site with each new order made. This metric is actually very important on it’s own as it can help you decide on whether you should be trying to increase your order frequency or increase your average order value.

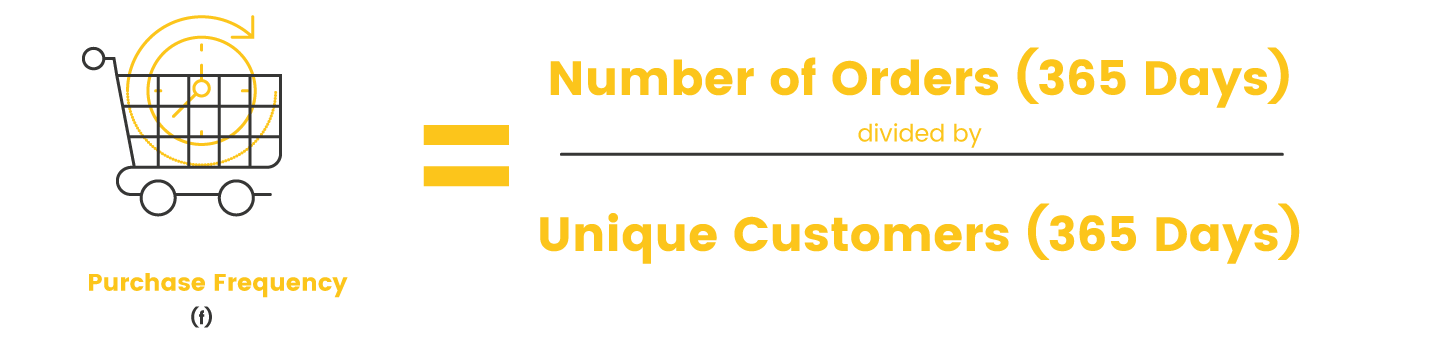

2. Purchase Frequency (f)

Purchase frequency (f) will tell you how many times a customer will purchase from your store in a given time period. For our simplified ecommerce CLV calculation, we’re going to look at everything from an annual perspective. This means that if you take the number of orders in the past year and divide that by the amount of unique customers that made an order in the past year, you’ll get the amount of times the average customer purchases from your site within a 1 year span.

Again, this metric is very important as it tells you how frequently your customers are making purchases from your site and whether or not they’re returning. Increasing your purchase frequency is quite a great growth strategy and can be done quite effectively through a few easy tactics.

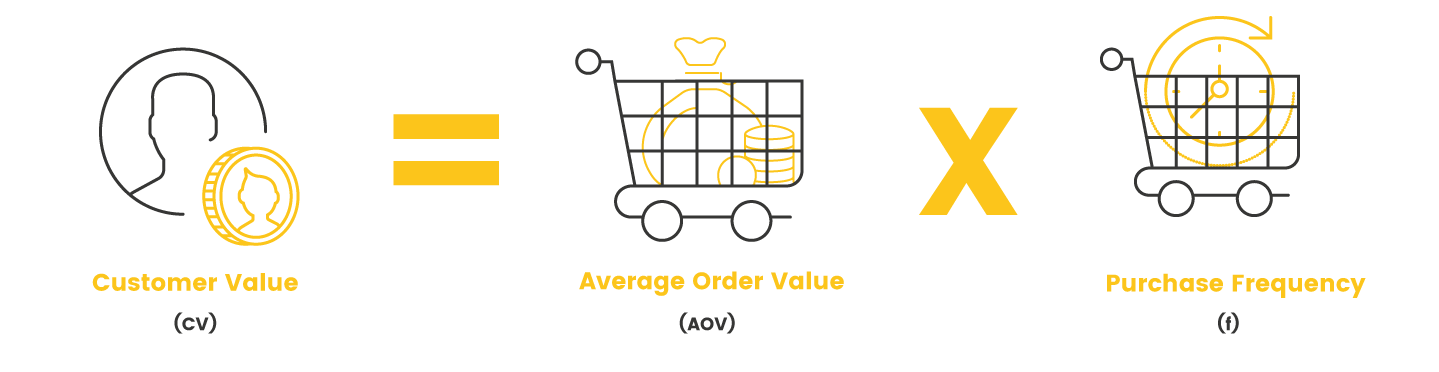

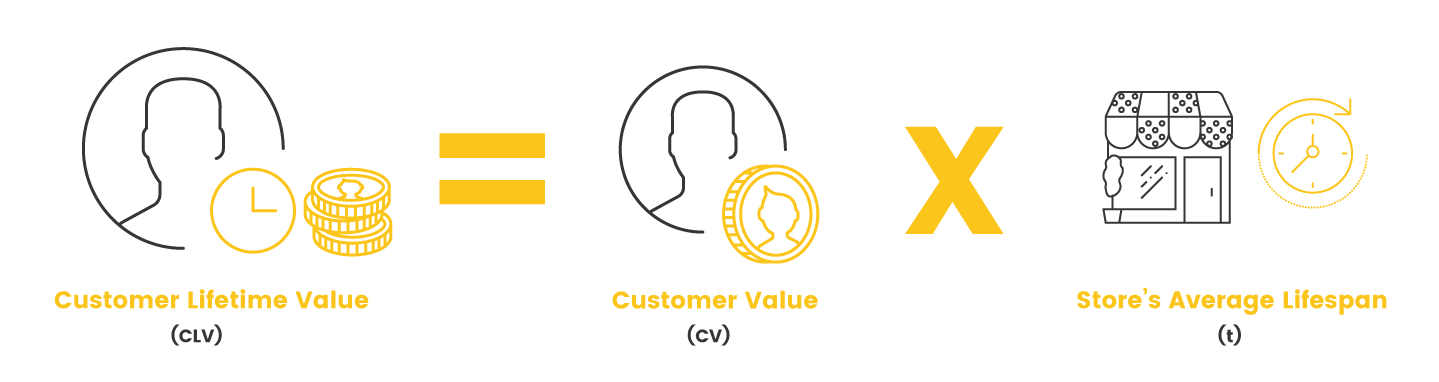

3. Customer Value (CV)

Before there is customer lifetime value, there is just customer value. This is the value of a customer’s average order multiplied by their purchase frequency. This will give you the value of a customer during the time frame you used to calculate average order value (AOV) and purchase frequency (f), which for us was 1 year.

4. Customer’s Average Lifespan (t)

This final piece of customer lifetime value may be the hardest one to accurately calculate. A customer’s average lifespan or (t) is the average time a customer remains active before they drop off and go “dormant”. Meaning that if the time between a customer’s first and last purchase is 365 days, then (t) would be equal to 365.

Instead of attempting to calculate this complex metric, we strongly recommend following the advice of proven ecommerce experts. Shopify and analytics guru Avinash Kaushik have determined 1-3 years to be a reasonable timespan for which customers remain active. For stores who know their customers have a limited attention span, such as certain hobby niches like trading card games or brain teaser puzzles, a shorter span like 1 or 2 years may be appropriate. For a clothing brand that continues to pump out fresh and new designs for years to come, your customers will most likely stay loyal for longer and continue to represent the brand for closer to 3 years.

The Customer Lifetime Value Formula

Now that we have the variables we need, we can look at how to discover the lifetime value of each customer! Here is the simplest way to calculate your store’s CLV:

By multiplying your customers annual value by how long the customers actually remain active, you get an accurate number for how valuable each customer is over their whole lifespan of being your customer. This number is incredibly valuable for you as it will tell you how much you should be looking to expense to acquire each new customer, and how much you should pay to keep them on as a loyal follower.

Customer Lifetime Value Calculation Variants

The simple equation displayed above is well, simple. It ignores a few things that are very important, such as your store’s margin and customer variance.

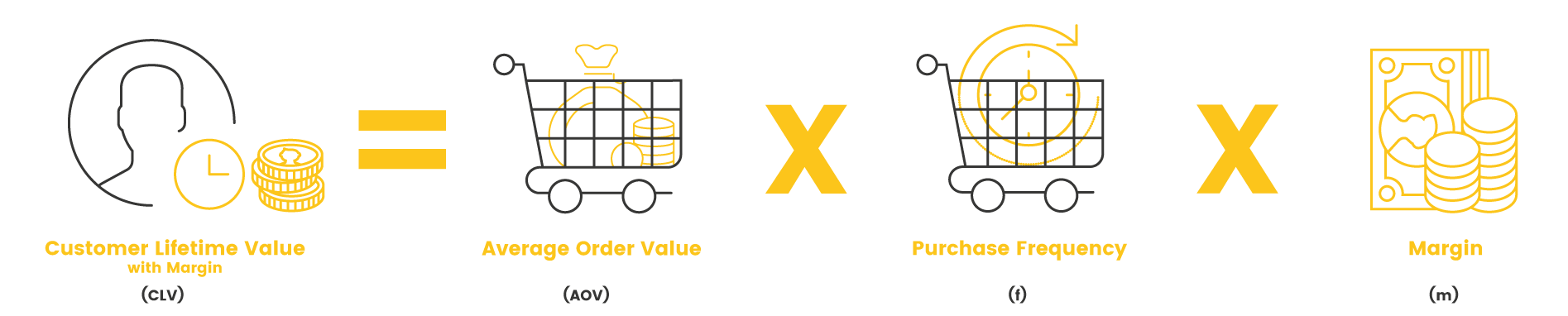

1. Customer Lifetime Value Including Margin

A customer lifetime value calculation becomes a lot more meaningful when you look at the margin you are going to see over the course of the shopper’s life. You might want to know the actual profit you will gain from each new customer, not just the revenue. This calculation factors in margin to order to determine the profit you will see from a customer.

2. Customer Lifetime Value by Segment

Calculating an aggregate CLV is great for making decisions on a store level, but segmentation is where you see its true value. There isn’t a new calculation here – instead, you just apply the formula to a specific segment of your customers.

There are endless possibilities for segmenting your ecommerce customers. Applying CLV to different segments allows you to see how profitable different types of customers are to your store. This allows you to see where you should be focusing your marketing efforts.

How you could segment:

Channels: Run a CLV formula on customers who were acquired from different channels. This allows you to see which channel is giving you the most value. You can then allocate more marketing budget or time to these more profitable channels.

Location: A CLV analysis on customer location can reveal areas that are more profitable to your store. Say you discover that shoppers from Canada have a much higher CLV. You can then adjust your marketing to target more of these customers.

Actions: Take a look to see how certain customer actions are impacting CLV. Are customers who are registered for your loyalty program generating more value? How much more is a registered account worth over its life? These are questions you can answer when you segment by actions.

You Need to Calculate Customer Lifetime Value

Even using a basic calculation for CLV puts you miles ahead of most merchants. Here at Smile.io we notice that only about 5% of merchants are actively calculating CLV to drive decisions.

You don’t need to make crazy calculations, you just need to be aware of the value that a customer provides over the course of their life. Being aware of your CLV allows you to make smart marketing decisions that drive long term growth for your small business!