Learning to calculate industry metrics is extremely important if you want to grow as a business owner. The thing is, not all metrics are created equal.

While there are many numbers that can help inform business decisions, some metrics combine insights from multiple calculations to give decision makers a deeper understanding of what makes their business tick. These special calculations are known as “magic metrics,” and working through these calculations is a great way to understand the way your business creates, delivers, and captures value. One of these magic metrics is customer lifetime value (CLV), which combines purchase frequency, average order value, and customer lifetime to figure what each customer is really worth to a brand.

While CLV is an extremely powerful metric to have in your toolkit, it isn’t the end of the story. Combining your store’s CLV with your CAC (customer acquisition cost) allows you to calculate an even more powerful number: the CLV:CAC ratio, the ultimate magic metric.

What Are CAC and CLV?

In order to calculate the ratio between customer acquisition cost and customer lifetime value, you first need to calculate both metrics individually. We’ve already written an in-depth guide on figuring out your CAC as well as a post about the easy way to calculate and improve your CLV, so we’ll keep the explanations fairly simple here.

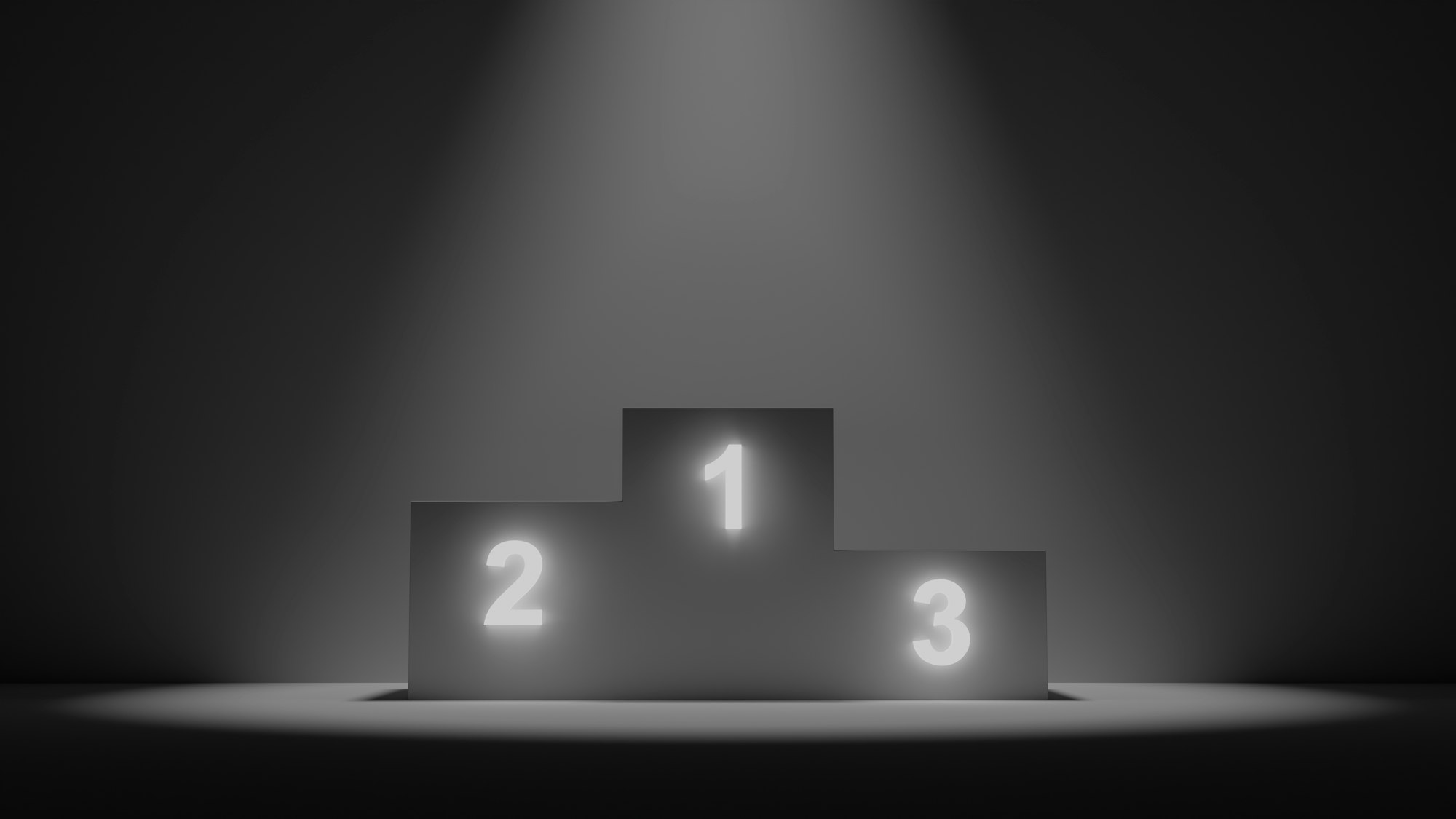

Customer acquisition cost is a representation of what it takes for your business to bring in a new customer. This is a valuable business metric because it breaks down the cost of large acquisition campaigns and assesses them on a per customer basis.

Whether you’re looking at the cost of free trials that convert new users or the cost of pay-per-click/impression ads on search engines and social media sites, you’ll always be able to answer the most important question: “what does each customer cost my business?”

At its core, customer acquisition cost asks the question: "What does each customer cost my business?"

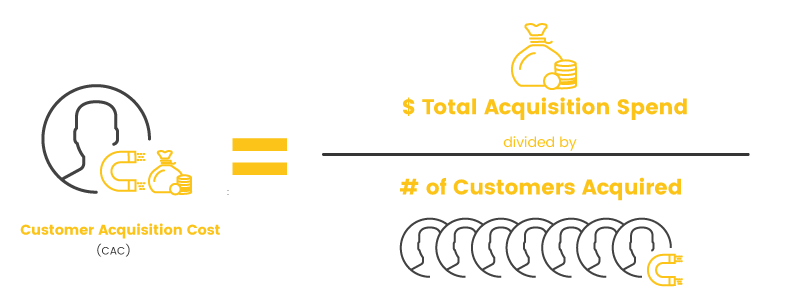

While customer acquisition cost looks at the value it takes to create a new customer, customer lifetime value looks at the other half of the equation - what happens once you actually have that customer. CLV uses a combination of average order value (AOV) and purchase frequency to estimate the average customer’s total value to the brand over the entire time they remain a customer.

The great thing about customer lifetime value is that it allows you to visualize each customer in terms of the total inflow of cash they can be expected to provide to your business. In other words, CLV answers the question: “how much is each customer worth to my business?”

A CLV calculation answers the question: "How much is each customer worth to my brand?"

How Do CAC and CLV Work Together?

As I mentioned, customer acquisition cost and customer lifetime value answer very fundamental questions:

- How much does a customer cost? (CAC)

- How much is a customer worth? (CLV)

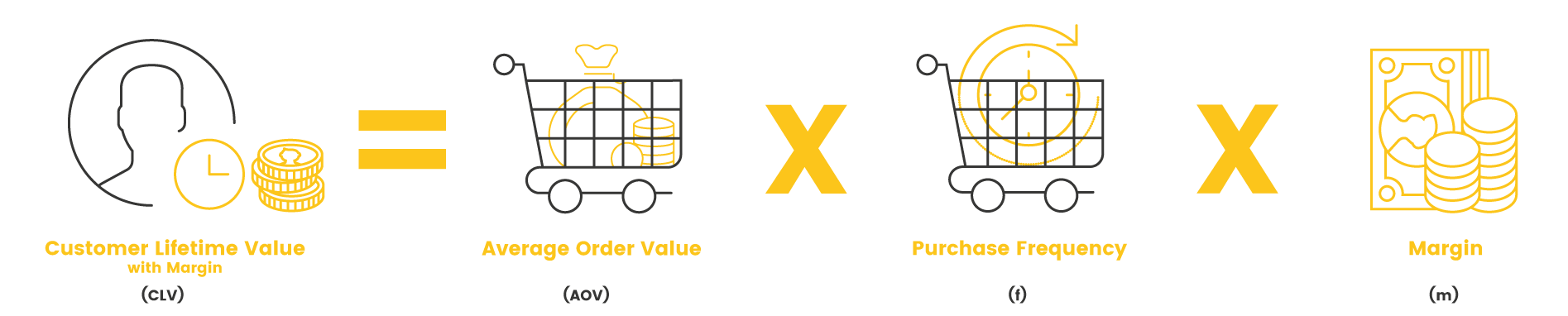

When you combine these questions, we can get at the more important question: to what extent is a customer worth their cost? In other words, what is the true value of a customer to my business?

Your CLV to CAC ratio asks the question: "What is the true value of a customer to my business?"

The CLV to CAC ratio helps us answer these questions by expressing customer lifetime value as a multiple (or a fraction) of customer acquisition costs. Is a customer worth double what they cost you? Are they worth half? You can find out pretty easily by dividing your CLV by your CAC as shown in the formula below!

This ratio tells the whole story of cash associated with the average customer - from the resources it took to win them over, to the revenue stream their repeat purchases represent. Analyzing this ratio is where you’ll find the real magic behind this metric.

To illustrate, it may help to examine the ratio as it pertains to Netflix - one of the most popular media streaming services on the planet. One tactic that helped Netflix become such a popular brand was that they made adopting the service a risk free move by offering a one month free trial.

This free trial represents a portion of Netflix’s customer acquisition costs. For simplicity’s sake, we’ll pretend those are the only acquisition costs. A quick look at the price points on the Netflix homepage will show you that the average Netflix subscription costs $11.32 per month which, being the price that Netflix is giving up to provide this free trial, would be Netflix’s CAC in this example.

Next we will turn to Netflix’s customer lifetime value. A quick search tells us that in 2011 Netflix had a churn rate of around 6%. If we reduce that number slightly (as the dust has likely settled in the years since then), we can use a round 5% for our example calculations. Using a monthly churn rate of 5%, we can calculate that the average customer will stay with Netflix for 20 months (1/churn rate = customer lifetime). Combining this customer lifetime with the price of a Netflix subscription leaves us with a customer lifetime value of 20 x $11.32 = $226.40.

So with a customer lifetime value of $226.40 and an acquisition cost of $11.32, Netflix is looking at about a 20:1 CLV to CAC ratio. If you’re thinking that worked out a little too easily, you’re right! However, while a brand like Netflix has advertising and marketing costs that should also factor into their CAC, at a high level you can see what the calculation is designed to do.

What CLV:CAC Ratio Should You Be Targeting?

I wish I could give you a magic number that would tell you the perfect CLV to CAC ratio for a healthy business, but unfortunately that’s just not possible. The truth is, like most metrics, your CLV to CAC ratio is highly context specific and a “healthy” value will vary depending on products, brands, and industries. That being said, there are a few things to consider when analyzing your ratio.

1) You Don't Want Your CLV:CAC Ratio to be Too Low

This tip might seem self explanatory, but it’s still worth saying. A CLV to CAC ratio that is too low is indicative of a brand that is spending too much to acquire customers that aren’t actually worth that much. A CLV to CAC ratio of 1:1 means that a customer ends up paying you back exactly what you paid to acquire them, leaving absolutely no room for profit! Brands like this are essentially wasting their time - the reality is, they could make the same amount of money simply by doing nothing.

If your CLV to CAC ratio is less than 1:1, RUN. You’re paying way too much to acquire your customers and something needs to change immediately. This situation is much more urgent than a CLV to CAC ratio of 1:1 because you’re not just wasting time - every second you stay in business under your current business model is digging you into a deeper financial hole.

If you’re looking for a hard number, many online resources cite 3:1 as a good target for your magic metric. Just remember that you’ll need to set that goal in the context of your industry for the best results.

2) You Don't Want Your CLV:CAC Ratio to be Too High

Now I know that at first glance this advice might seem a bit counterintuitive, but bear with me. A CLV ratio that is too high (like our Netflix example of 20:1) is often indicative of a brand that isn’t spending enough based on how much their customers are worth. Simply put, if your customers are worth a lot to your business then put your money where your mouth is and let them know it!

If your customers have a high lifetime value to you, then they have a high lifetime value to your competitors as well. If you’re not willing to shell out to money to acquire them effectively, it’s almost guaranteed that your competition will.

Returning to Netflix, we know that once we factor in the costs of marketing and advertising their CLV to CAC ratio will fall drastically from 20:1, and that’s okay. In fact, it means that Netflix is making smart investments to acquire customers while still leaving room for profit. Again, the qualification for “too high” will be industry specific but research shows upper targets between 5:1 and 10:1.

3) Think About Your Payback Period

An interesting metric that often comes up alongside CLV and CAC calculations is the idea of a payback period. Your payback period reflects how long it takes for a business to recover its acquisition costs from a customer. If a customer were to churn before their payback period, the business would be operating at a loss with regard to that customer. However, once a customer makes it past the payback period, any future purchases provide pure value to the business.

In our simplified Netflix example, the customer acquisition cost was the $11.32 free trial. This cost gets recovered after the customer’s first paying month, and then all future months of the customer’s subscription are a cost free benefit to the business. All things held constant, the higher your CLV to CAC ratio the faster your payback period will be, and the more value your business will be able to generate from each customer.