With new commerce businesses entering the market every day, there is an increase in competition, making customer loyalty more important than ever. It's estimated that 35% of an ecommerce store's revenue is generated by the top 5% of customers.

Smile.io CEO and Co-founder Mike Rossi explains, “As advertising gets more expensive and crowded, brands should be able to survive a shock to the system - their normal marketing channels becoming unprofitable over time."

Consumer sentiment and spending have grown on average less than 1% every month since September 2024, with disposable personal income increasing 0.4% at the end of 2024. As consumers cautiously spend and become selective on where to spend their disposable income, we see the opportunity for commerce brands to capture customers and their loyalty.

Key Takeaways:

- Loyalty-generated value grew Year over Year (YoY) in all major commerce industries in 2024 compared to 2023, showing an increase in loyalty and rewards program engagement and business impact.

- Loyalty-generated value increased for all merchants with more than 500 monthly orders in 2024. Small—to medium-sized brands processing between 500 and 5,000 monthly orders saw the greatest YoY growth of 23.93%. This signals up-and-coming brands are gaining loyal customers who are actively engaged in their loyalty programs and returning for repeat purchases.

- Consumers are returning to shop across industries. Repeat customer rates are increasing YoY, industry-wide. This indicates increased customer retention and loyalty among shoppers across ecommerce brands and the commerce industry as a whole.

- Small brands can also have big wins. You don’t have to be a big brand to see order values increase. Merchants with less than 500 orders a month saw the biggest AOV increase, with 20.58%. This shows that consumer spending is favoring smaller, up-and-coming brands, with consumers often spending their money here rather than at large retailers or established big brands.

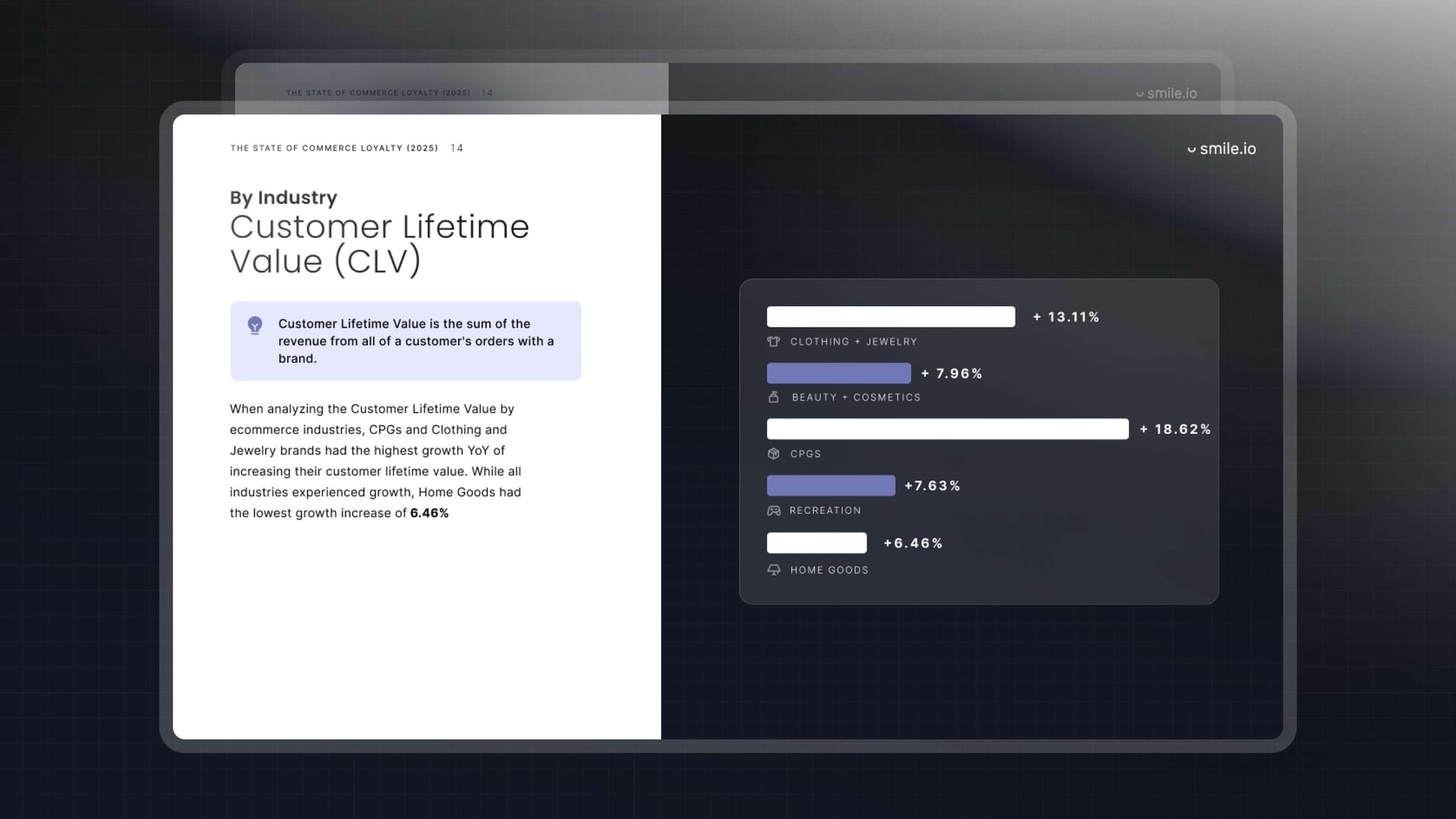

- When analyzing the Customer Lifetime Value by ecommerce industries, CPGs and Clothing and Jewelry brands had the highest growth YoY in customer lifetime value. While all industries experienced growth, Home Goods had the lowest growth increase of 6.46%.

- Growing brands in the CPGs and Recreation are securing more frequent orders from repeat customers. All major ecommerce industries increased their purchase frequency. CPGs saw the largest increase of 13.95% YoY, followed by Recreation brands with an 8.68% YoY growth.

Download the full report:

For this report, Smile.io analyzed over 100,000 ecommerce merchants in 148 countries, examining customer loyalty metrics from the full year of 2024 (January 1 - December 31, 2024) to the full previous year of 2023 (January 1 - December 31, 2023).

The sample size for this study includes 585 million orders. Using the world's largest dataset of loyalty and retention data, we report on key metrics, including:

- Loyalty Generated Value

- Repeat Customer Rate (RPR)

- Average Order Value (AOV)

- Purchase Frequency (PF)

- Customer Lifetime Value (CLV)